Omnichannel Delivery: Banking Based On Members

Advances in technology, especially in the mobile space, have drawn new players to financial services—everything from nimble, innovative fintech firms to giant technology companies. Credit unions now face competition not only from banks, but also from companies that can offer consumers “invisible banking,” a term being used to refer to the frictionless banking advanced by these new competitors. The current demand is for convenient, secure and automated omnichannel services to make banking easier and faster for consumers.

More closely connected than ever

As a society, consumers are more closely connected than ever through the web of digital interactions made through social media, online purchases, and banking. Companies are taking advantage of this continuous, data-rich connection by reducing friction for consumers using their products, building a deeper relationship and, ultimately, creating a better consumer experience.

Non-traditional players, like fintech or bigtech, are quickly outpacing traditional financial institutions, using their advanced technology to provide the highly desired frictionless, omnichannel service. Leading innovators not only provide consumers with automated service, ensuring consumers spend the least amount of energy using their services, but they also provide a curated experience that understands and anticipates each customer’s unique needs.

Hello, bigtech

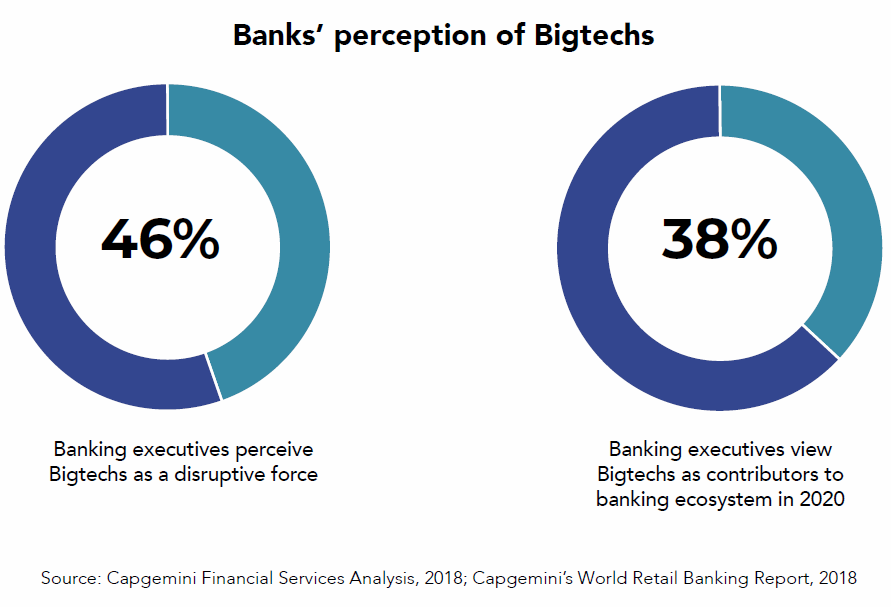

The threat posed by bigtech is quite unlike the competition from banks and small fintechs that credit unions are accustomed to. According to an analysis by the tech firm Capgemini in 2018, over 45 percent of banking executives believe bigtechs are a disruptive force in the industry. Bigtechs bring with them a large and oftentimes extremely dedicated customer base. These are companies that not only produce a quality product with quality service, but also are excellent at branding themselves and growing customer engagement. Bigtechs, due to their technology base, excel at collecting and analyzing data. Perhaps more worryingly, they have also begun to leverage open banking APIs.

Banking should revolve around members

Before credit unions scrutinize whether or not their channels are “invisible,” they should review their general omnichannel practices. People of all ages are changing the way they bank and the channels they use to bank. Lacking a strong mobile or online presence can be a major problem. Consumers not only want an easier way to interact with their financial institutions, but also variety in the ways they do so. Most do not stick strictly to one channel but use different channels depending on what appeals most to them at the time.

Financial institutions may not be ready

The term “omnichannel” has been thrown about for several years now, but financial institutions still say they are not ready to execute on omnichannel delivery. According to a survey by Celnet, only 13 percent of institutions are in the execution phase, while 45 percent are still doing preliminary research for what is needed. Institutions with assets under $1 billion are especially lagging, compared to the larger organizations that are in the phase of developing, refining or executing on their omnichannel delivery.

Credit unions need to ensure that their omnichannel infrastructure:

- Allows members to communicate through the channel of their choice

- Captures data through multiple touchpoints, allowing for analysis and insights

- Allows for the personalization of the user experience

- Is consistent across all channels

The end goal of omnichannel delivery is to provide a seamless experience that not only creates convenience for the consumer, but also allows an organization to learn more about its audience. At its core, the reasoning behind omnichannel strategy is to shift to a client-centric view rather than institution-centric. Instead of interacting with members only through transactions, credit unions need to engage them through experiences.

« Return to "CUSG Blog Corner"