How Useful Are Member Personas for Credit Union Marketing Teams?

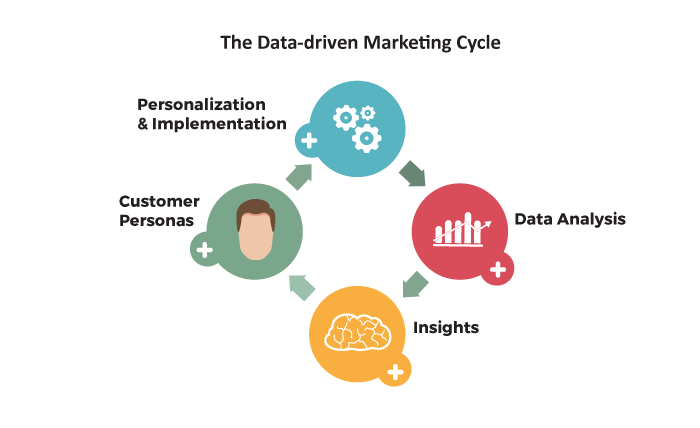

A common question after a company has analyzed consumer data and produced marketing insights is, what’s next? At this point, a marketing team already has a detailed map of its audience demographics, needs and preferences. So, how are these insights put to practical use?

A common question after a company has analyzed consumer data and produced marketing insights is, what’s next? At this point, a marketing team already has a detailed map of its audience demographics, needs and preferences. So, how are these insights put to practical use?

Personalized marketing is expected these days

Building customer personas (or buyer personas, as they’re also called) is a big part of the move toward personalized marketing across all industries. By now, consumers are fairly apathetic to marketing that pushes something at them without offering an apparent solution that makes their lives easier. Consumers want to feel engaged and courted by their financial institutions. As a result, banks and credit unions are looking into ways to create a more tailored experience for their customers.

Customer personas as tools

Customer personas are important tools in creating personalized, targeted online marketing campaigns. These personas are profiles of the typical customer/member that financial institutions can use to speak more specifically and accurately to their audience. For credit unions, these profiles identify key audiences, what banking services they are currently using, what services they will need in the near future, their preferences for content and how best to market to them.

Benefits of customer personas

- Create tighter marketing focus and content development

- Segment contract database

- Provide direction for product positioning and development

- Help the sales team tailor their pitch

- Provide a guideline for branding

Where to gather information to build profiles

- From employees – Marketing teams, frontline staff and customer service teams deal with members the most and will have the best understanding of a credit union’s member base. When constructing a customer persona, it’s best to develop a well-rounded profile by speaking with staff who interact with members at different parts of their journey.

- From members – Why not get insights straight from the source? Surveys or polls could bring to light unforeseen problems.

- From the data – Financial institutions are digging into transactional data to produce insights specifically for the purpose of improving the customer experience and improving their sales approach. Some of the larger institutions are already using customer data to model out which consumers will need which future services and products.

Utilizing customer personas enables a company to tweak core branding and messages to resonate more powerfully with their varied audiences. Thankfully, this process isn’t a shot in the dark — there are mountains of data to inform this marketing strategy with information pulled directly from the source. Be sure you aren’t wasting these valuable tools.

« Return to "CUSG Blog Corner"

- Share on Facebook: How Useful Are Member Personas for Credit Union Marketing Teams?

- Share on Twitter: How Useful Are Member Personas for Credit Union Marketing Teams?

- Share on LinkedIn: How Useful Are Member Personas for Credit Union Marketing Teams?

- Share on Pinterest: How Useful Are Member Personas for Credit Union Marketing Teams?