Conversational Commerce and the Rise of the Chatbot

Have a plan for conversational commerce in your omnichannel strategy

Whether or not you think it’s a buzzword, many organizations are approaching omnichannel strategy as an absolute necessity. A recent study of 46,000 consumers found that omnichannel tactics are giving adopters a competitive advantage, and a whopping 73% of consumers used multiple channels during their shopping journey. The study, conducted by researchers at Medallia and Rice University, also found that the more channels a consumer used, the more valuable they were. On average, customers that used more than 4 channels spent 9% more than those who just used one channel.

It is little surprise that so many financial institutions are eager to expand their omnichannel strategy, yet only a small portion believe they are well positioned.

PWC survey

- 61% of FI executives say that a customer-centric model is important

- 75% of FIs are making investments in this area

- Only 17% of FIs feel prepared

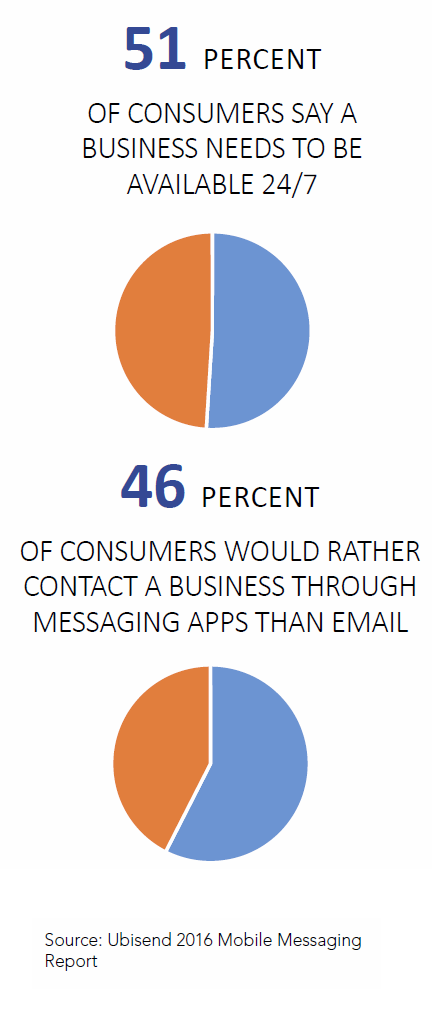

Credit unions looking at adopting and developing chatbot technology should also ask themselves how the technology fits into their omnichannel strategy. As a whole, the financial services industry is slow to take up new channels in communicating with their customers. Even now, as banks and credit unions are exploring channels of communication such as Facebook Messenger or within their own respective apps, financial institutions find themselves hampered by limited manpower. When customers expect real-time, personalized responses, even the largest customer service team would find themselves stretched thin. Especially on channels such as Facebook messenger, where response times are typically long.

An ace up your sleeve

For credit unions, chatbots could be an ace up the sleeve due to their ability to respond to both general questions, and specific questions related to a member’s account, automatically and with little need for oversight.

"The true test for conversational commerce is in the ability to solve real problems and guide customers through meaningful and sometimes complex commercial and financial activities," said David Sosna, co-founder and CEO of Personetics, in a press release. "Doing that requires the ability to analyze individual customer behavior and provide intelligent assistance that is truly personalized."

« Return to "CUSG Blog Corner"